[MKT] BlackRock 15.9M shs +27.24% 1-21-26 [MKT] Sumitomo Mitsui 13.6M shs +53.36% 1-23-26

[MKT] BlackRock 15.9M shs +27.24% 1-21-26 [MKT] Sumitomo Mitsui 13.6M shs +53.36% 1-23-26

[MKT] BlackRock 15.9M shs +27.24% 1-21-26 [MKT] Sumitomo Mitsui 13.6M shs +53.36% 1-23-26

[MKT] BlackRock 15.9M shs +27.24% 1-21-26 [MKT] Sumitomo Mitsui 13.6M shs +53.36% 1-23-26

[MKT] BlackRock 15.9M shs +27.24% 1-21-26 [MKT] Sumitomo Mitsui 13.6M shs +53.36% 1-23-26

[MKT] BlackRock 15.9M shs +27.24% 1-21-26 [MKT] Sumitomo Mitsui 13.6M shs +53.36% 1-23-26

EIA Stakeholder Position VERIFICATION

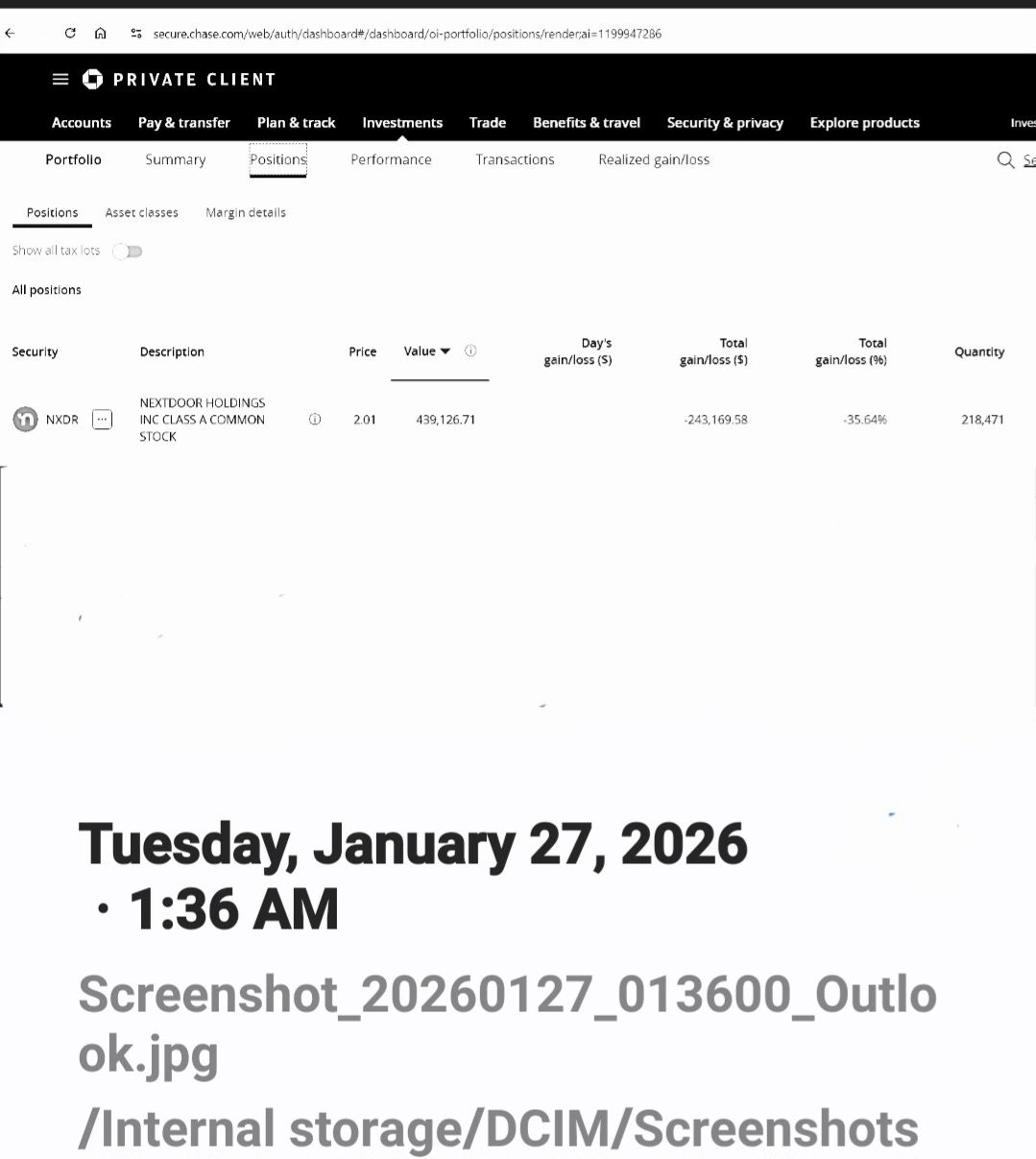

Of Its ($NXDR) Shares being held by Chase Bank for: 218,471 Shares

Pursuant to SEC Regulations EIA does hereby provide substantiation of its Positions in Both Its core holdings in Nextdoor Holdings, Inc. ($NXDR)

Posted Below is a Screenshot of EIA's Core Holdings from its Chase "Private Client" computer monitor taken on January 27, 2026 at 1:36 AM, PT. The screenshot shows to the far right 218,471 shares of ($NXDR) are Currently Held in Good Standing.

There is NO MARGIN taken against this Core holding.

Ehrlich Institutional Agentics (EIA) operating as, EhrlichAgentics.com has taken the position that ($NXDR) is currently trading at its Intrinsic Fair Value, representing a significant discount to the platform’s projected utility.

EIA is VERY Bullish and Is NOT SELLING!

EIA like all of the Hedge Funds Accumulating ($NXDR) at an alarming rate is of the Opinion that $NXDR's Avail Float is Compressing to the point where any good news with give rise to a "MAJOR FLOAT SQUEEZE."

Any good news on Nextdoor Holdings, Inc. raised by its Board, or Earnings calls, by Analysts or Mr. Eric Jackson may cause a parabolic rise in price action.

EIA Stakeholder Position VERIFICATION

Of Its ($NXDR) Shares being held by Robinhood Securities for: 95,000 Shares

Pursuant to SEC Regulations EIA does hereby provide substantiation of its Positions in Both Its core holdings in Nextdoor Holdings, Inc. ($NXDR)

Posted Below is a Screenshot of EIA's Core Holdings from its Chase "Private Client" computer monitor taken on January 27, 2026 at 1:06 AM, PT. The screenshot shows to the far right 95,000 shares of ($NXDR) are Currently Held in Good Standing.

There is NO MARGIN taken against this Core holding.

Ehrlich Institutional Agentics (EIA) operating as, EhrlichAgentics.com has taken the position that ($NXDR) is currently trading at its Intrinsic Fair Value, representing a significant discount to the platform’s projected utility.

EIA is VERY Bullish and Is NOT SELLING!

EIA like all of the Hedge Funds Accumulating ($NXDR) at an alarming rate is of the Opinion that $NXDR's Avail Float is Compressing to the point where any good news with give rise to a "MAJOR FLOAT SQUEEZE."

Any good news on Nextdoor Holdings, Inc. raised by its Board, or Earnings calls, by Analysts or Mr. Eric Jackson may cause a parabolic rise in price action.

EIA Technical Thesis & Mandate:

As a premier, top-rated, Google-indexed "NXDR 100 X Research Hub" with a rare 98/100 SEO optimization score, Ehrlich Institutional Agentics (EIA) maintains a high-conviction 313,471 share position in Nextdoor Holdings, Inc. ($NXDR). Deploying a Capital Rotation strategy from a 30-year Real Estate development legacy, EIA identifies $NXDR as the definitive digital conversion of physical property's RE Commerce via the preeminent Agentic-AI Architecture to unlock Addressable Marketplace Liquidity across its $2Trillion Marketplace.

The thesis is anchored by Unifying Network Effects, a Deterministic Zero-Bot Identity Graph, and a stair-step trajectory toward EBITDA breakeven in 2026. This asymmetric exponential growth opportunity is modeled as a Power Law Case with a target valuation of $374. EIA advocates for the $97M share repurchase program to exploit valuation dislocation and catalyze a High-Fidelity Proximity Squeeze. This System of Intelligence pivot is exclusive to $NXDR's RE dataset and is the newest unassailable Tranche of this Category Definition called the Geospatial AI Gateway which is clearly supported by net-zero margin debt for absolute structural stability. All statements contained herein are EIA’s opinions only.

SEC DISCLOSURE:

This presentation is for informational and strategic assessment purposes only. The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities, including but not limited to $NXDR. This communication is not intended as financial, legal, tax, or investment advice. Stakeholders in $NXDR and the author have a direct or indirect financial interest in the assets discussed, which presents a potential conflict of interest. Invest wisely and never invest more than you can afford to lose. All projections are "forward-looking statements" and involve inherent market risks.

Past performance is not indicative of future results. No regulatory body, including the U.S. Securities and Exchange Commission (SEC), has passed upon the merits of or given approval to this pitch or the accuracy of the underlying data. Recipients should conduct independent verification of all singular entries and consult with a registered investment professional before capital allocation. This entity is a closed-end Stakeholder of 313,471 shares of $NXDR and does NOT invest funds for others. Information herein does project guarantees of profitability.

Investing in Stocks carries inherent risks of Capital Loss. All statements contained herein are EIA's Opinions only. Do not rely solely on these opinions. No calculations are used to arrive at this thesis. Investors of $NXDR are advised to perform due diligence before investing and rely on their own personal data and decisions.

Non-Affiliation & Endorsement Disclaimer:

Nextdoor Holdings, Inc. ($NXDR) does not endorse, sponsor, or maintain any ownership interest in this entity or its affiliated firms. There is no formal partnership, joint venture, or agency relationship between the entities. All trademarks and brand assets associated with $NXDR are the property of their respective owners and are used herein for identification and analytical purposes only under "fair use" principles.

Date: January 27, 2026

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.